Va loan lenders that accept bad credit

Check Your Credit Score. You must be 18 or older a US.

Va Loan Fees Loan Va Loan Loans For Bad Credit

970800 in high-priced areas Eligible properties You must live in the home.

. USAA also has non-VA loan options. USAAs VA loan products include a fixed-rate 30-year purchase loan a jumbo fixed-rate purchase loan and a VA refinance option. The application takes as little as 60 seconds and once you submit it youll receive multiple offers from various lenders.

A bad credit score is not an issue with title loans in Virginia. Lenders like to see a low debt-to-income ratio and if your ratio is greater than 43 -- so your debt payments take up no more than 43 of your income -- most mortgage lenders wont accept you. The amount they are.

The company has over 100 years of combined experience. This can help reduce your need for home loans for veterans with bad credit and potentially raise your FICO score. This service is all about direct lenders.

CarsDirect accepts borrowers of all credit types so its an easy one-stop shop for anyone looking for an auto loan. You wont be able to close on a VA loan until you have a clear CAIVRS. FMC Lending Best for Bad Credit Score.

If you worry about low credit scores affecting your ability to qualify for a VA mortgage there are steps you can takewe recommend taking these steps at least 12 months in advance as early as possible is best. VA loans are available with no down payment requirement for veterans active military and their spouses with credit scores as low as 500. This specialized database tracks current delinquencies and defaults within the last three years on things like federal student loans FHA loans and other federal programs.

Angel Oak Mortgage Solutions offers a variety of non-qm loan programs including bank statement loans 1099 income mortgages asset depletion loans jumbo loans conventional mortgages and an investor cash flow mortgage program. Minimum Credit Score Loan Terms range Maximum Loan Amount Nationwide Home Loans Group Best Overall. Why Some VA Lenders do Not Accept Poor Credit.

Here are five steps to take before applying for a car loan. Citizen or permanent resident and the owner of a checking account to complete the online form on the website. No limit unless borrower defaulted on or has more than one VA loan if so 647200 in most areas.

Customers can be sure that they can always count on direct lenders. If you are seeking a loan for more than 548250 lenders in certain locations may be able to provide terms that are different from those shown. They offer loan amounts between 150000-3000000.

VA Loan with Bad Credit Scores 500-620. VA lenders are protected from part of the loss in the event of a foreclosure or default. While other lending companies refuse to provide a loan to people whose credit score is bad direct lenders will offer cash.

BuildBuyRefi formerly Nationwide Home Loans Group is a division of Magnolia Bank. Loans Above 548250 May Have Different Loan Terms. Auto lenders who accept an applicant with a low or no credit score will typically charge a higher interest.

We chose BuildBuyRefi as our best overall construction loan lender because it lends in 47 states offers loans with low down payments and low interest rates and can finance the land the construction and a permanent. They will just check if a customer can afford it. The overwhelming majority of service members and veterans receive lower interest rates with the VA home loan program over traditional mortgages.

VA lenders will run your name against the Credit Alert Interactive Voice Response System CAIVRS. Sign up for a credit monitoring service and begin checking. 15 or 30 years.

You can use their quick quote form to see what you may qualify for. Theyve been in the business for nearly 20 years and have helped 5 million customers in that time. This is thanks to the financial backing given by the Department of Veterans Affairs as the loan guarantor which allows lenders to assume less risk and in turn provide lower interest rates.

Openstreetmap Mortgage Lenders Mortgage Rates Va Loan

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval In 2022 Fha Mortgage Credit Score Fha

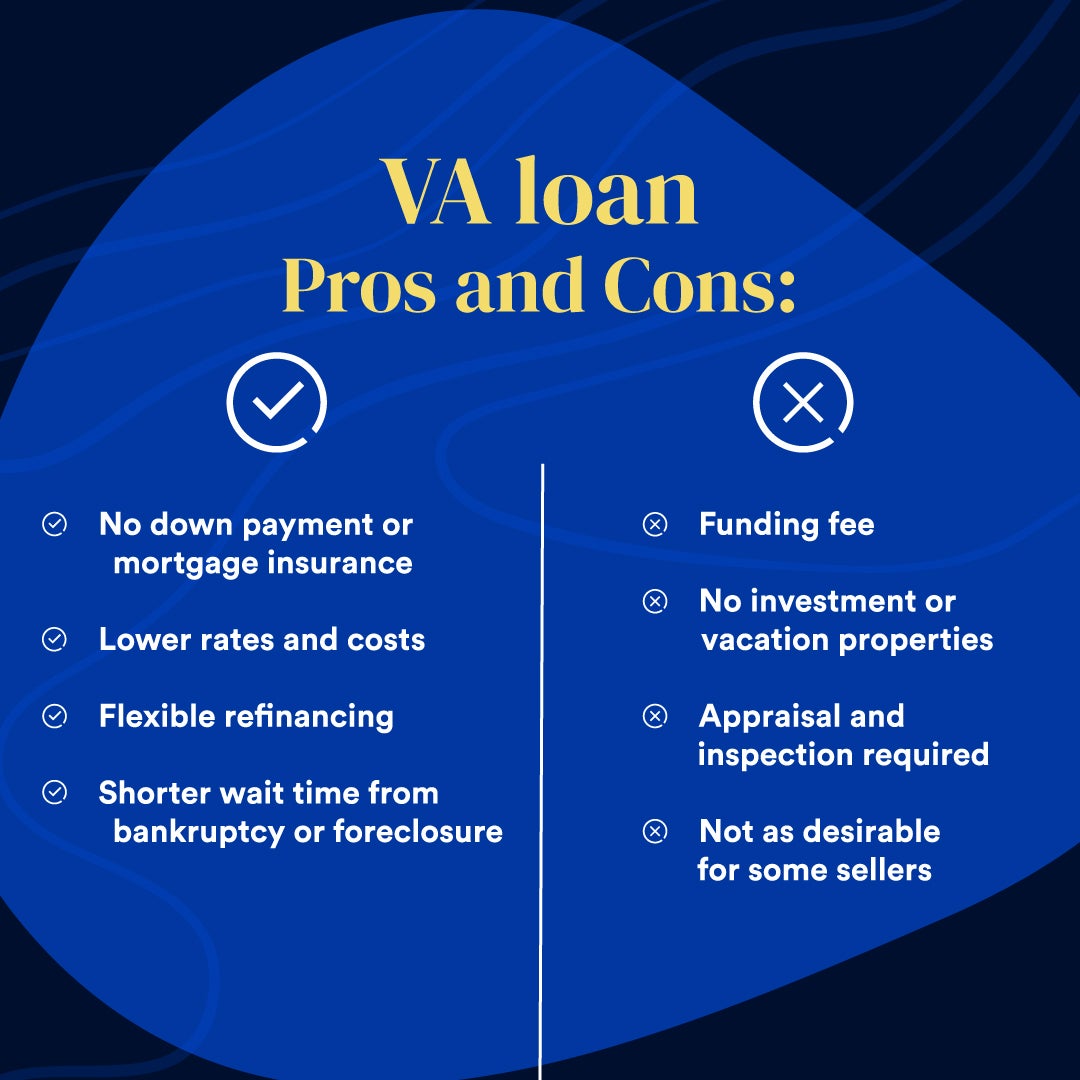

Va Loan Pros And Cons Mortgage Loan Originator Va Loan Home Loans

Kentucky Va Loan Credit Score Requirements Va Mortgage Loans Mortgage Loans Bad Credit Mortgage

Looking For A Va Mortgage Lender Ask These 9 Questions Of The Lenders You Re Considering To Make Sur Mortgage Tips Mortgage Lenders Improve Your Credit Score

Kentucky Va Loan Credit Score Requirements Va Loan Loan Credit Score

Va Loans Everything You Need To Know Jvm Lending

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

9 Key Benefits Of Using A Va Loan Va Loan Va Mortgage Loans Home Loans

Ultimate Home Buyers Checklist Save Time Money House Down Payment Home Financing Mortgage Loans

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Va Mortgage Loans Bad Credit Mortgage Mortgage Loans

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

Kentucky Va Loans Offer 100 Financing Refinance Mortgage Same Day Loans Loans For Bad Credit

Pin On Pinterest For Real Estate Marketing

Kentucky Va Loan Credit Score Requirements Va Loan Loan Credit Score

Va Loans Pros And Cons Bankrate